December 2006 - Dollar-Real Estate-Stock Markets: US consumer's insolvency, a catalyst of the impact phase of the global systemic crisis

The American mid-term elections have now passed and, only a week later, as announced by LEAP/E2020 in GEAB N°8 of last October 15, the “euphorisation” of US voters/consumers and world financial players seems to have already passed wit them. The development process of the global systemic crisis has resumed its course, artificially stopped last July due to the upcoming mid-term elections, as shown by the recent changes in the Dollar’s value and by the latest US economy indicators. In parallel, a series of topics which had curiously disappeared from the pages of financial media these last months is reappearing, such as the end of the “carry-trade” based on the Yen [1], increasing fears of the risk of implosion of the market for derivatives and “hedge funds” [2] and of course the uninterrupted fall of US real estate [3] with its procession of negative consequences on American growth[4] (all these developments generating from now on increasing reflection as to the health of the US banking sector, one depending more and more on unsound debt [5]). For the team of LEAP/E2020, all these trends, which mark the beginning of the impact phase of the global systemic crisis, have a common catalyst, and that is the insolvency of the US consumer in the framework of a generalized degradation of the quality of credit to all US financial and economic operators [6].

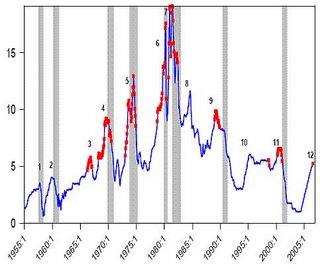

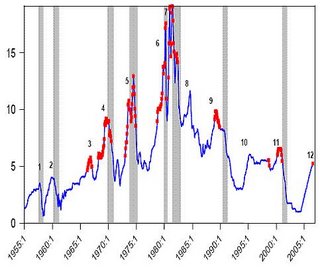

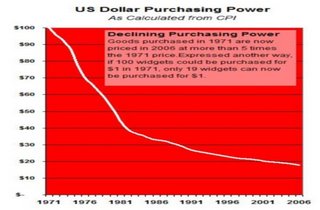

Chart 1 – US Household Debt

For more than five years the American consumer has been the “cash-cow” of US growth, contributing more than 70% to the resulting progression of the United States economy. Stimulated by the easy money policy promoted by the US Federal Reserve in order to avoid a catastrophic recession feared after the explosion of “internet bubble”, the US consumer rushed into a frenzy of purchases of consumer goods. Encouraged by banks and the whole US financial system, he exceeded his own financing capacities and plunged since 2004 into generalized debt [7] and into a situation not seen in the United States since the dip of the Great Depression post 1929, namely a negative saving rate [8].

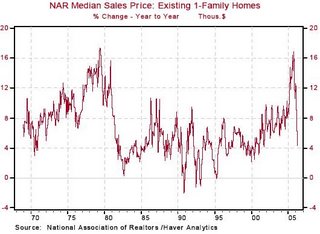

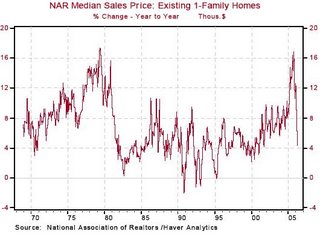

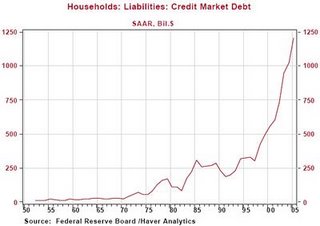

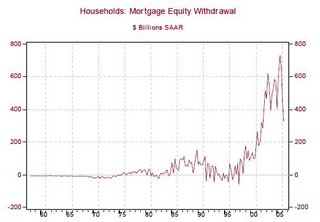

The Federal Reserve, the Bush administration and the republican Congress, as well all the financial and banking sectors of the country then fed the fiction of a continuous and fast enrichment via the development of the “real estate bubble” which convinced the majority of the country’s middle class, including its least ‘well off’, to rush into a strategy of purchase, and often of speculation, in real estate [9]. In parallel, the very strong growth of real-estate prices made it possible for the financial sector to offer loans for household consumption, linked with the “value” of the real estate . Because of these operations relating to more than 2,500 billion dollars since 2004, these same lenders and other banks have in same time increased considerably their results, gaining the admiration of stock markets by their extraordinary success, whereas these same assessments were potentially seen to be depending more and more on the future evolution of the real estate market.

Chart 2 – Recent collapse of consumer credit linked to real estate (source Safehaven)

Indeed, the obvious risk of this strategy of the banking sector was due to the possibility of an inversion in real estate trends. In the event of a strong and sustained fall in the prices and volumes of the real estate market simultaneously on the whole of the US territory, the “magic circle” of individual enrichment and the collective growth would become an “infernal spiral” of personal debt and generalized recession. Indeed, households in debt would suddenly become insolvent because of the collapse in the price of the real estate guaranteeing their loans, while the whole of the banking sector would be found in a double trap with on one side an increasing share of the loans not refunded due to personal bankruptcy, and on the other a financial assessment quickly down-grading because of the depreciation of the value of the guaranteed loans (namely the real estate) [10].

For the LEAP/E2020 team, it is from now on time to remove the ‘conditional’ from this scenario. It is currently happening throughout all the United States and constitutes a catalyst of the impact phase of the global systemic crisis. The US consumer, i.e. the US middle class, basically becomes insolvent [11], victim of overwhelming debt, a negative rate of saving, the bursting of the real estate bubble, the rise of interest rates and the collapse of US growth. All these elements are dependent, and mutually reinforcing, to plunge the United States, starting from the end 2006, into an economic, social and political crisis without precedent [12].

Very concretely, this November issue of GEAB sounds two “LEAP/E2020 Alerts”:

- The first relating to banking and finance sectors which, by the way of “hedge funds” and “bad quality credit”, will be at the centre of the impact phase of the global systemic crisis;

- And the other, which again amplifies the Alert published in GEAB N°4, relating to European real estate, with as an illustration, an analysis of the market trends of the British and French real estate.

The GlobalEurope Anticipation Bulletin is the confidential monthly newsletter of European think-tank LEAP/Europe 2020 (available by subscription)

---------

Notes :

1. Source ”Dollar drops vs yen after Japanese central banker's comment on yen carry trade”, International Herald Tribune, 10/11/2006

2. Sources « ‘Panic selling’ hits derivatives markets », Financial Times, 05/11/2006; “Investors regroup as swaps panic hits”, The Australian/FT Business, 07/11/2006

3. Source : « National foreclosures increase 17% in the third quarter », RealtyTrac, 01/11/2006

4. Source “Negative numbers keep popping up in the data”, MarketWatch/DowJones, 12/11/2006

5. Source “Foreclosure : the buck stops where?”, Twincities.com, 22/10/2006

6. Source “US credit quality in 25-year retreat toward junk-S&P”, Reuters, 02/11/2006

7. Source “The valley of the shadow of debt”, From the wilderness, 11/08/2006

8. Source « US savings rate hits lowest level since 1933 », MSNBC, 30/01/2006

9. US consumers have thus obtained from the banking and financial sectors consumption loans linked with their real-estate amounting to 633 billion dollars in 2004 and 719 billion dollars in 2005. Source « End of the bubble bailouts », Forbes, 29/08/2006

10. This type of development knows similar examples in History. cf. « Restructuring the US economy – downward », Kurt Richebächer, FS0, 27/10/2006

11. The consumer thus becomes the « weak link » of the US economic and financial chain, after being its engine in the past five years. Source CFO/TheEconomist, 10/11/2006

12. In this field, a very interesting CNN series is worth the visit: « Broken Government ».

© Copyright Europe 2020