November 2006: beginning of the phase of impact of the global systemic crisis

Last May, in the Global Europe Anticipation Bulletin N°5, LEAP/E2020 had detailed the four phases of the global systemic crisis, indicating that the phase known as of acceleration would start in June and would be spread out over a period of a maximum six months at which stage, the explosive phase of the crisis, the “impact phase”, would start.

Following these last months developments and the central part played by the United States in the current global system, LEAP/E2020 announces in its October edition of GEAB (GlobalEurope Anticipation Bulletin N°8) that the phase of impact will begin in November 2006 and that this phase’s catalyst will be the mid-term elections of the United States Congress[1] which is the cross point of the main fracture lines of the current global system.

The phase of acceleration consisted of the generalized realization that the global system that we have been familiar with for several decades is changing radically and permanently as the following, now largely recognized, trends for the whole planet illustrate [2]: aggravation of the nuclear crises with North Korea and Iran, general lack of power of the United States on all major crises of these last months, including the Israeli-Palestinian conflict[3], civil war in Iraq and American stagnation up until at least 2010[4] , growing feeling of the defeat of the West to progress in Afghanistan [5], collapse of the United States real estate market[6], increasing volatility of the “hedge funds” system [7], starting recession of the US economy[8], aggravation of trade deficits and American payments[9], on-going weakening of the Dollar[10], increasing debt of American households[11].

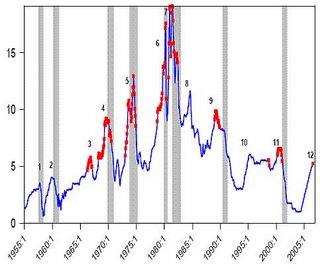

Chart 1 - Federal Funds Rate - Red Squares Denote Periods when the Fed Funds

Rate was Higher than the Long Treasury. Source: NoSpinForecast

The phase of impact which succeeds the phase of acceleration constitutes a period when a series of brutal crises starts affecting by contamination the total system. This explosive phase of the crisis, which will last six months to one year, will affect directly and very strongly financial players and markets, the owners of investment schemes with fixed incomes in dollars, pension’s funds and the strategic relations between the United States on the one side, and Europe and Asia on the other.

According to our analyses, its impact will be much stronger in the financial sector than our forecasts of the first half of 2006 suggested, because the mobilization of this sector in the United States (together with its communication relays) in order to preserve the control of the Republican Party in the American Congress, led to “euphorise” the American public opinion and the immense majority of the players in this sector, enabling the leaders of this party to claim a good economic assessment (the only campaign topic at their disposal since summer 2006) [12]) . The using of this side of the global system for electoral ends thus prevented the majority of the players from correctly anticipating the ruptures to come and as such will considerably increase the explosive potential of the impact phase in this sector, since the operators will be caught “on the wrong foot”.

At the center of the « euphoria » process of US voters, one will find the business bank Goldman Sachs in particular. The latter, whose former president, Henry Paulson became the US Finance Minister a few months ago, is at the origin of a technical decision that led to an artificial collapse of oil rates in the past weeks. Indeed Goldman Sachs abruptly changed the composition of his GSCI indicator (Goldman Sachs Commodity Index), a reference on Chigaco’s raw materials market, thus compelling traders to sell more than 100 billion US dollars of “future” oil contracts between August and September 2006.

Chart 2 – Unleaded gas - Nymex - source AT-Bourse

Moreover, the prominent influence of this business bank (one that became the most important global « hedge funds ») is also present in the “Working Group on Financial Markets”, (often called « Plunge Protection Team »), created by the Executive Order 12631 [13], with the objective “to maintain the confidence of investors”, and which, under the direction of people named there by G. W. Bush, and headed by Henry Paulson, is in a position to activate all influential Wall Street or Chicago players.

In this October issue dedicated “The impact phase of the Global Systemic Crisis”, LEAP/E2020 analyzes the detail of this “euphoria” process of the players by breaking down the mechanisms used to convince American voters and world financial operators that the future is radiant, whereas all the objective indicators are sounding alarms [14] in terms of American growth, employment[15], inflation, strategic risks control, etc…

In addition, the LEAP/E2020 team tries to anticipate the development mode and the consequences of the impact phase on sectors or operators particularly exposed, such as the operators and financial markets, the owners of American investment funds with fixed incomes, the operators involved in real estate industry and in financing the real estate market and pension funds.

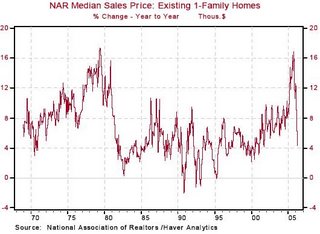

Chart 3 – Median sales price - Single family homes

LEAP/E2020 also attempted to anticipate the role of “hedge funds” in the explosive process of the impact phase, which will transform their “risks mutualisation” into a “risk systemic contagion”. On this subject, LEAP/E2020 sounds the alarm on the entire American financial sector and in particular on the main “hedge funds”, which investment banks such as Goldman Sachs or Lehman Brothers as well as the main American « primary dealers » authorised by the United States Federal Reserve have become.

According to the LEAP/E2020 team, the time has come when the motivations of the US Fed in stopping the M3 publication last March will be revealed ; and the consequences of this strategy will « catch on the wrong foot » who naively chose to share the general euphoria built up in the perspective of the US November election. From then on, as explained in GEAB N°8, a brand new story starts. That of the impact phase of the global systemic crisis.

----------------------------------------------------------

1. Cf analysis in GEAB N°7: “American legislative Elections - November 2006: Towards a politico-institutional blocking in Washington, with important political , economic, and commercial consequences”

2. Whereas in the first quarter of 2006, when LEAP/E2020 produced its first projections on the subject, the large majority of the players involved and public opinions worldwide were convinced of the opposite trends, and even denied that those which are obvious today could simply appear in the future.

3. Even the Israeli public opinion has become very critical towards the incapacity of the United States in the region, as explained in Gideon Levy’s article « The Mystery of America » , published in Haaretz, 09/10/2006

4. This is what the American leader of combined forces, General Peter J. Schoomaker, has just declared. Source CBS News, 11/10/2006

5. 89% of the Europeans probed via GlobalEurometre estimate that NATO is losing the war in Afghanistan.

6. On this subject, it is interesting to keep in mind the projection of the current President of the American Federal Reserve who declared one year ago that “there was no real estate bubble which could explode” (Washington Post source, 27/10/2005).

7. Even China has joined the voices worrying about the increasing risks caused by the out-of-control development of hedge funds. Source West Australian/Daily Telegraph, 29/09/2006

8. Read the note on US employment from the Center for Economic and Policy Research (CEPR, 06/10/2006)

9. Source Roubini Global Economics services, RGE, 12/10/2006

10. This issue of Global Europe Anticipation Bulletin explains in particular why the downward trend of the Dollar is currently temporarily stabilized because of the proximity of the American election

11. Beyond the continuously increasing personal debt since the saving rate continues to be negative, USA Today calculated that, by incorporating the national debt, each American household has now a debt of more than US$500,000. Source the USA Today, 24/05/2006

12. It is very useful to observe that the topics of G.W. Bush public interventions, as recorded by the Republican Party website, moved away from “the fight against terrorism” towards “the good health of the economy”. Source: Speech of September 2006, Speech of October 2006, Republican Party

13. Source: Federal Register, US National Files, 11/1998, Executive Order 12631/Working Group one Financial Markets

14. For example, the 9/10/2006 issue of Chicago Tribune titles its business page with the increasing recession risks. It is the case of a great number of American regional media which are very sensitive to the direct consequences of the real estate collapse.

15. Read the note on the US employment from the Center for Economic and Policy Research (CEPR, 06/10/2006)

0 Comments:

Enregistrer un commentaire

<< Home